The UK has cut the reduced Value Added Tax on hospitality services from the current 20% standard rate, to the reduced rate of 5% on 15 July 2020. The hope is that this will boost the economy after the effects of Coronvirus, and create new jobs to reduce unemployment.

No-one will be left “without hope”, Chancellor Rishi Sunak expresses.

The announcement was made in the Chancellor’s economic update and the measure will be in place from 15 July 2020, until 12 January 2021, costing £4 billion. This £4 billion adds to the current total of £49 billion that has been spent on UK public COVID-19 support.

The cut covers: Restaurants, cafes, pubs (ex alcohol), hospitality, hotels, B&B’s, home rental, caravan and tent sites, hot take away food, theatres, circuses, amusement parks, concerts, museums, zoos, cinemas, and exhibitions. Note: served alcoholic drinks will not benefit from the cut.

Hospitality covers: restaurants; cafes; entrance to tourism and cultural events; hotels and accommodation – including house rentals.

Pegasus Opera 3

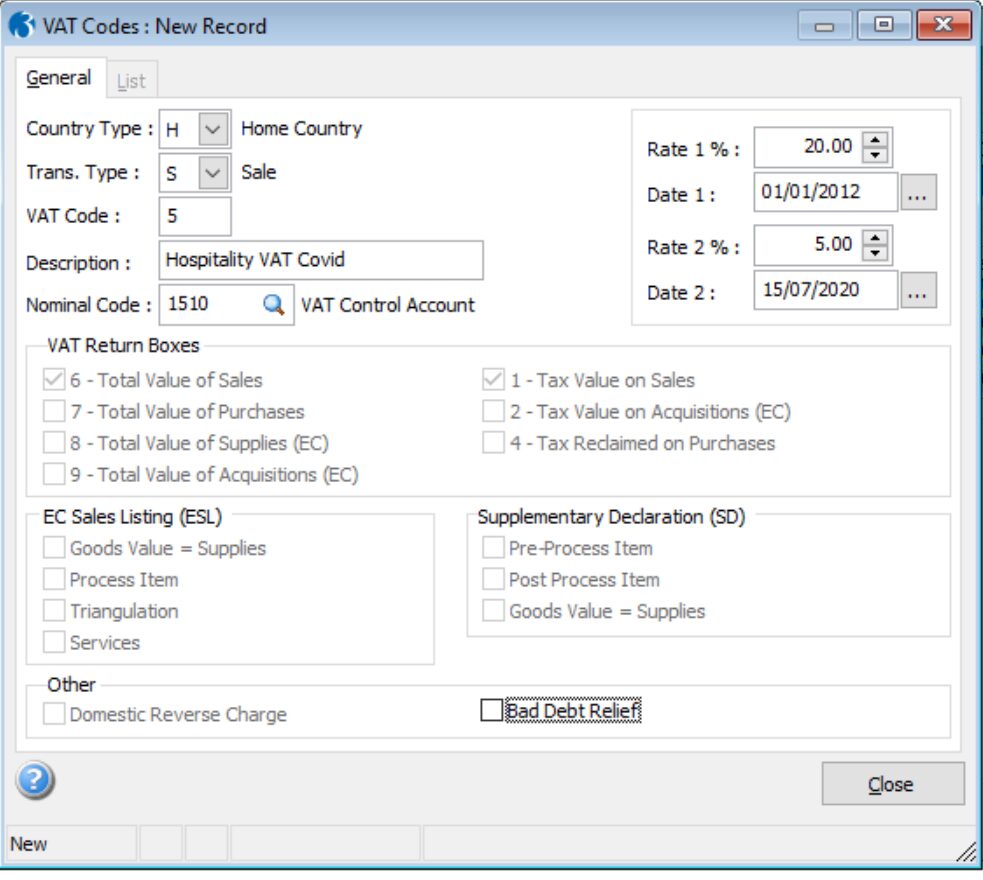

The good news is, if you are using Pegasus Opera 3 and this applies to you, you can either setup new or amend existing codes in your Opera software.

- Simply access the VAT codes under VAT Processing or MTD VAT Centre (if used) from the Opera 3 system menu.

- Add a new or amend existing VAT code on system enter the new rate in Rate 2% and the start date in the Date 2 field.

- The new rate will automatically come in effect from this date.

Further advice or information

- If you are having any trouble please get in contact with your technical adviser who will be able to assist.

- You can also visit the GOV.UK website for further details on the VAT reduction

Written By Tom Race.